The Era of Stock Buybacks

Stock buybacks have become a hot topic in recent years. These buybacks have become a cornerstone of corporate finance, influencing stock prices and corporate valuations. With the ever-growing presence of buybacks in the media and now more recently, the political sphere, we wanted to provide some insight into how they function and how they should be viewed.

What Exactly are Buybacks?

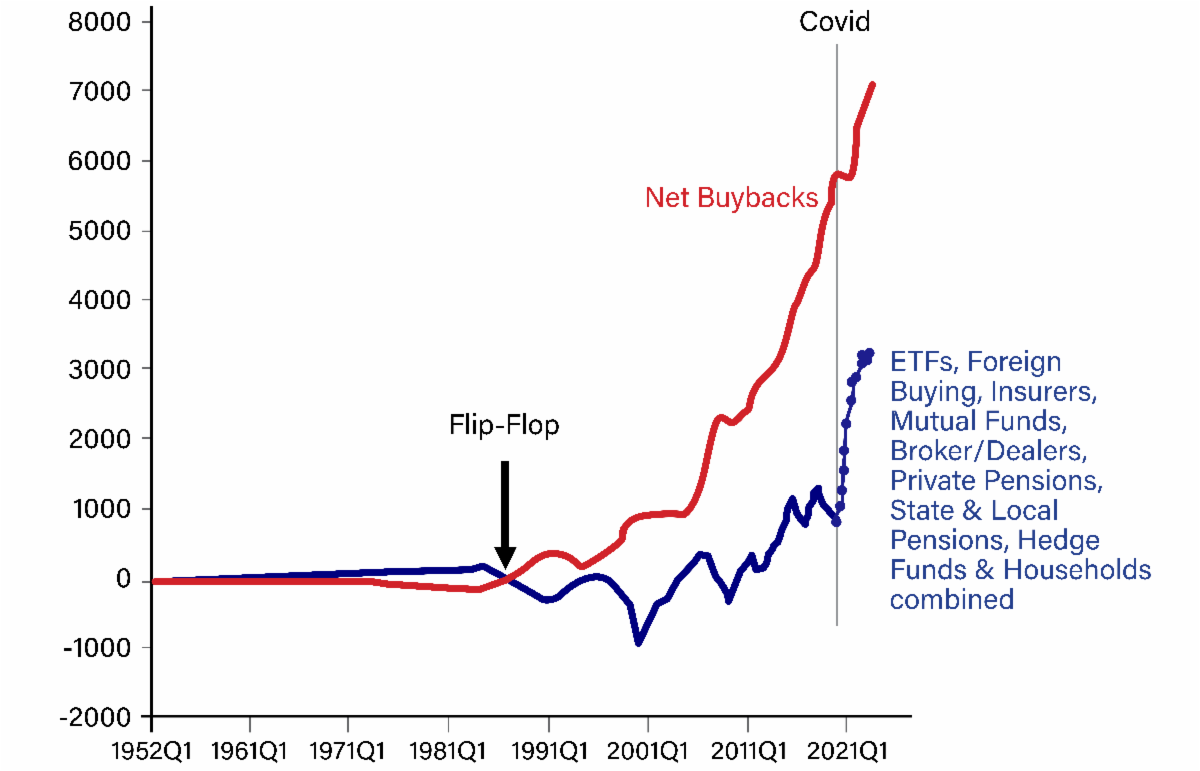

Cumulative Stock Purchases from 1951 in $ Bil.

"Companies vs. Investors"

Source: FRB

Source: FRB

A stock buyback, or share repurchase, is when a company acquires (buys back) its own shares from the market. This action reduces the number of outstanding shares, often with the objective of enhancing shareholder value and consolidating ownership. Companies carry out buybacks through open market purchases or tender offers, subtly altering their financial landscape.

Originating in the 20th century, stock buybacks were relatively uncommon until regulatory changes, such as the SEC's Rule 10b-18 in 1982, simplified the process. Since then, the frequency and scale of buybacks have varied, but there has been a noticeable increase in recent years. This trend is driven by factors such as tax consideration, shareholder expectations, interest rates, and stock-based compensation.

Where Does the Money for Buybacks Come From?

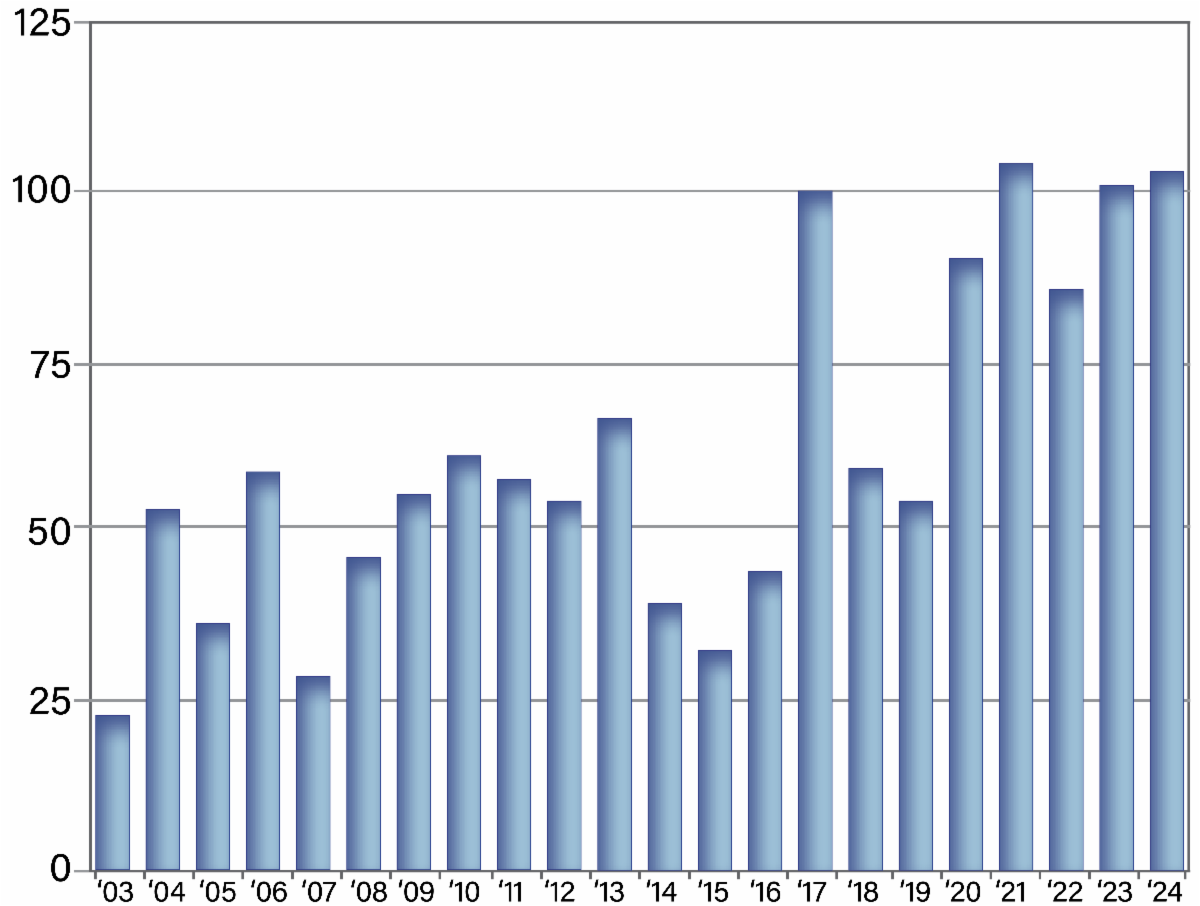

Companies fund buybacks from free cash flow or through issuing debt to fund the purchase of their own stock in the market. Free cash flow comes from normal business operations while the demand for debt comes primarily from pensions & endowments. When pensions & endowments need to add more fixed rate credit, they look to the corporate bond market. The new corporate debt enables companies to repurchase their shares with the proceeds. This practice is very common today. Seen in the figure below, corporate bond issuance has been elevated in the past decade. These debt issuances will continue to fuel buybacks moving forward as we move into a friendlier low interest rate environment and these institutional buyers continue to look for higher yielding corporate bonds to meet long-term obligations.

January New Corporate Bond Purchases | First 7 Trading Days, in $bil

Source: Bloomberg

Who Benefits from Buybacks and What are the Alternatives?

The beneficiaries of buybacks are a matter of debate. While proponents claim shareholders, including executives and employees with stock-based compensation, directly benefit, critics highlight the potential for valuation manipulation and the opportunity cost of not reinvesting in the business.

When a company with free cash flow opts for buybacks over reinvesting in research and development, it simply suggests the companies are deploying capital in the best way they see fit, at that time. Nonetheless, investors often prefer buybacks to dividends as they can simulate a dividend without the tax implications.

Political Considerations and Public Perception

Buybacks have become a political policy weapon. Public opinion often scrutinizes this practice, questioning its legality and impact on corporate social responsibility and wealth distribution. The media sometimes views buybacks with skepticism, echoing this sentiment.

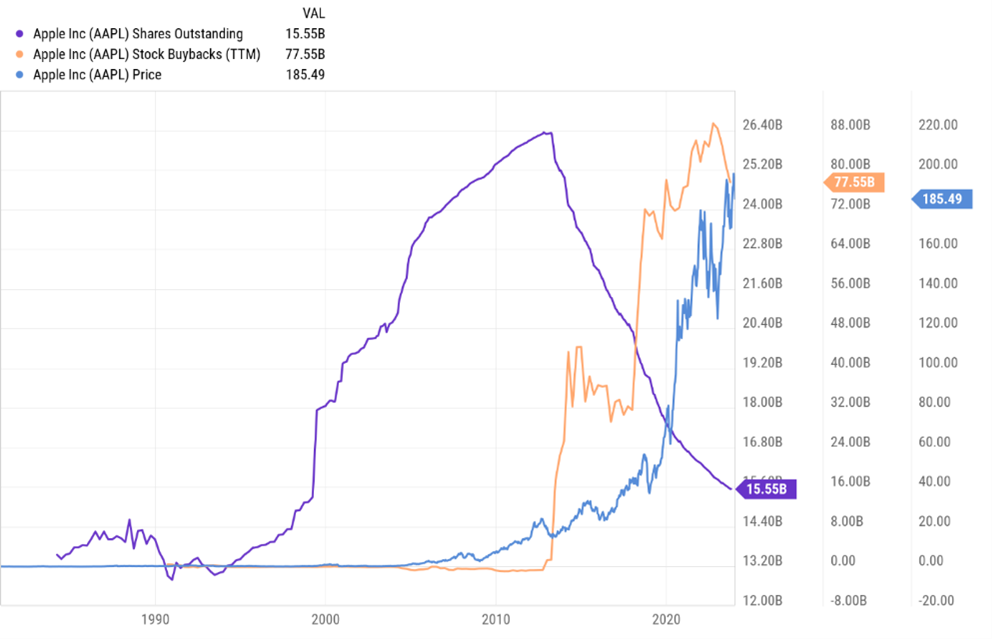

Recent examples, such as Apple's $90 billion repurchase in May of 2023 (amounting to 3.4% of all outstanding shares), illustrate how established companies use buybacks to manage excess capital and meet shareholder expectations. These significant repurchases are hot topics for financial analysis and debate.

Source: YCharts

We believe that buybacks will continue to increase substantially over time. The driving forces for the increase will be primarily from employee stock-based compensation plans, an interest rate environment where the Federal Reserve will be cutting rates to meet their long-term target, and increased demand for corporate debt by pensions and endowments.

Andrew Cialek, CFP®