Beyond Diversification:

How Generational Wealth and Nostalgia Are Powering the $500B Collectibles Market

A new kind of investment boom is underway, and it’s not in stocks or bonds. It’s in sneakers, vintage toys, sealed video games, wrist watches, classic cars, cards, and even Power Ranger masks. For investors, this movement isn’t just cultural curiosity. It’s a window into how generational behavior is reshaping the broader definition of wealth and what it means to diversify beyond traditional markets.

As $100 trillion in wealth transitions from Baby Boomers to Millennials and Gen Z, the definition of “collectible” is changing. What once meant rare coins, stamps, or fine antiques now includes pop-culture artifacts and limited-edition consumer goods. Collectibles aren’t new, they’re simply evolving alongside the generations inheriting and earning new wealth.

The Wealth Transition & the Nostalgia Engine

The greatest wealth transfer in modern history is underway. As Boomers retire, their accumulated capital, estimated at over $80 trillion, is beginning to flow to younger heirs who think differently about money and meaning.

Millennials and Gen Z investors aren’t drawn to the traditional symbols of wealth like fine art or china sets. Instead, they’re putting their money into the things that defined their own lives: sneakers, vintage toys, classic video games, and pop-culture memorabilia. Having grown up in a digital world, they’re entirely comfortable buying and selling through online marketplaces and social platforms. For them, collecting isn’t just about ownership. It’s about connection, nostalgia, and belonging. The result has been a remarkable surge in the collectibles market.

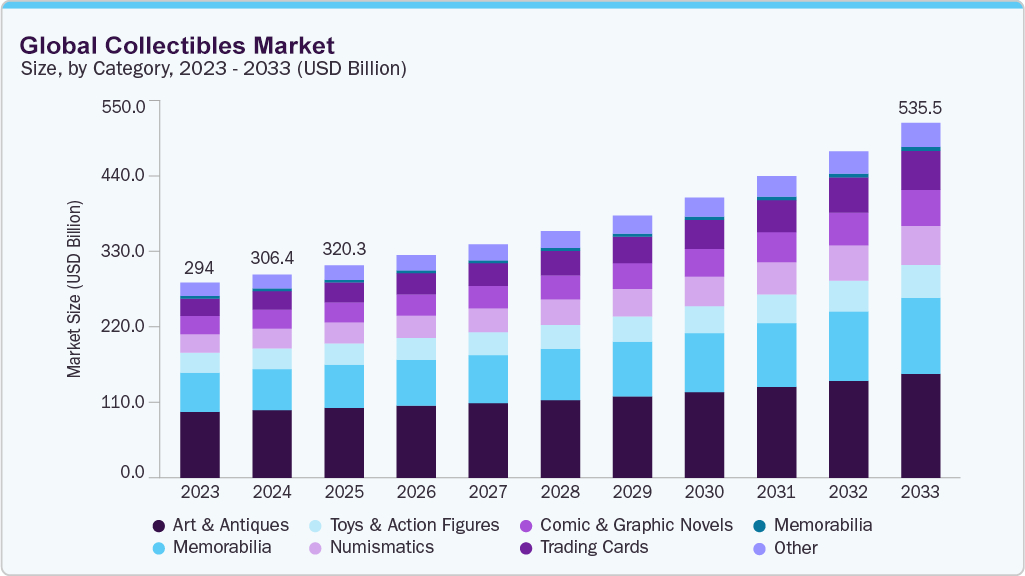

Source: Grand View Research

As seen above, the global collectibles market was valued at $294 billion in 2023 and is projected to reach roughly $535 billion by 2033. In the U.S., the market reached $62 billion in 2024 and is expected to rise to $84 billion over the next decade. The secondary collectibles market is also booming, growing from $142 billion in 2024 to a projected $249 billion by 2034.

Once a niche pursuit, collectibles are now a legitimate part of the investment conversation. Much like fine art, wine, or classic cars, modern collectibles combine scarcity and storytelling just expressed through a different generation’s lens.

Source: LA Times. Shoppers wait in line outside the Century City Pop Mart store in October 2025. Some arrived as early as 2:30 a.m. The Century City store only had 40 labubu purses for sale during the October launch.

Collectible Categories: From Common to Uncommon

Sneakers – Limited releases from Nike or Adidas can resell for multiples of retail price. The blend of street culture, scarcity, and digital hype has created a billion-dollar resale ecosystem.

Watches – Vintage Rolex Daytonas, Audemars Piguet Royal Oaks, Patek Philippe, and F.P. Journe models remain luxury staples and inflation hedges for collectors seeking timeless craftsmanship.

Exotic & Classic Cars – Vintage Ferraris, Porsche 911s, and early Lamborghinis have become portable stores of value. Many now trade on specialized platforms with annualized appreciation rivaling equities.

Video Games – Sealed Nintendo or Sega cartridges, early Sony PlayStation consoles, and limited editions fetch tens of thousands at auction. Nostalgia meets digital rarity.

Toys & Action Figures – Star Wars figurines, GI Joes, Lego Sets, and Transformers from the ’70s–’90s now command record prices when unopened.

Art, Pop-Art & Memorabilia – Prints, celebrity artifacts, and original pop-art pieces are bridging the gap between cultural relevance and traditional fine art.

Power Ranger masks and other cult TV show props, once kids’ costume pieces, now valuable nostalgia.

Obscure memorabilia from smaller franchises or local pop phenomena like Labubus.

Modern trading cards, including not just baseball, but also Pokémon and Magic: The Gathering, have seen exponential gains.

Sealed consoles or “never-opened” electronics are treated like modern antiques.

Limited-edition streetwear collaborations (Supreme, Off-White, KAWS) are blurring fashion, art, and investment.

Commemorative coins and designer stamps, reborn for younger digital-first collectors.

Data & Signals: Evidence of the Boom

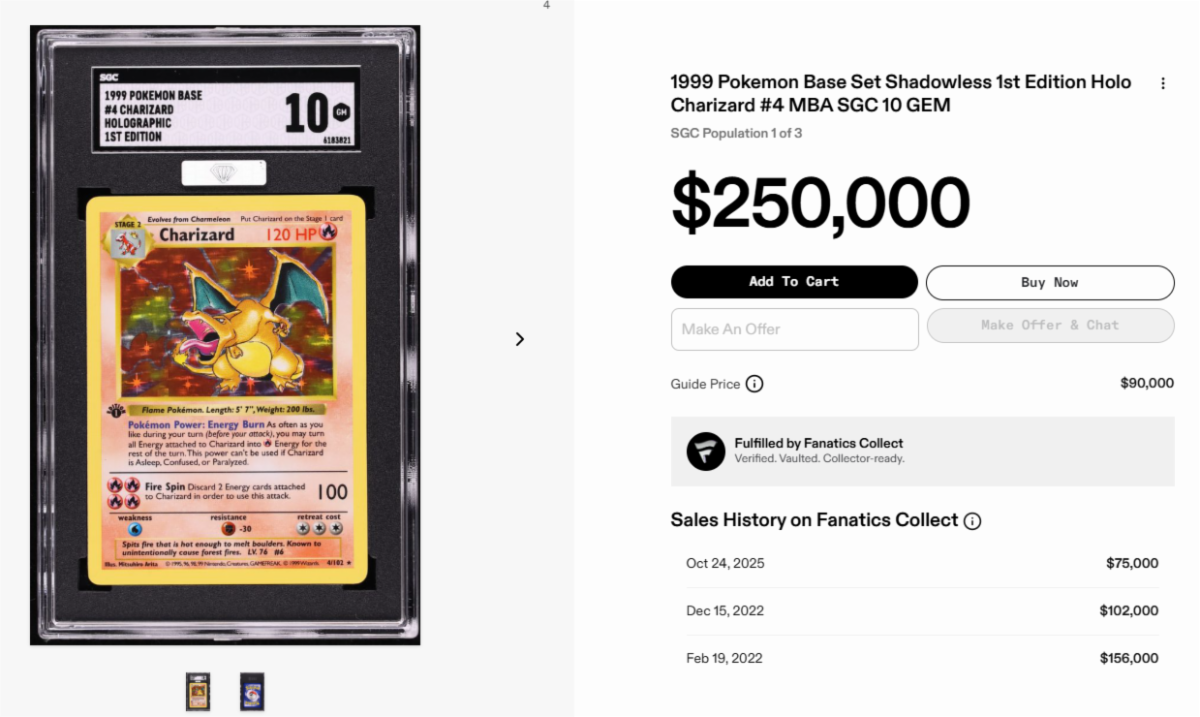

Source: Fanatics Collect. “1999 Pokémon Base Set Shadowless 1st Edition Holo Charizard #4 MBA SGC 10 GEM.” Accessed November 6, 2025. Screenshot captured from active listing showing a price of $250,000.

Access to the market has also expanded significantly. Online platforms and social media have opened the door for more participants, while authentication services such as PSA, CGC, and Whatnot have helped reduce risk. At the same time, YouTube and TikTok have fueled both visibility and hype. Within this landscape, rarity and condition carry tremendous weight. Unopened, sealed, or graded-mint items can command extraordinary premiums, sometimes ten times the price of their used counterparts.

Causes & Drivers

- Nostalgia as an asset – The emotional link to childhood culture drives both enjoyment and demand.

- Digital access – Global marketplaces like eBay, StockX, and Heritage Auctions have made trading frictionless.

- Alternative-asset hunger – In a world of high equity valuations and unpredictable yields, tangibles provide perceived safety.

- Influencer economy – Hype cycles, celebrity endorsements, and social virality push prices and participation.

- Authentication infrastructure – Grading and provenance services reduce uncertainty and support liquidity.

- Sustainability & circular economy – Reselling fits modern values: reuse, uniqueness, story-driven consumption

Implications for Investors

However, collectibles also come with real risks that require caution. These assets can be highly illiquid, with sales often contingent on finding the right buyer, sometimes long after an investor wishes to sell. Value can evaporate quickly if an item’s condition or authenticity is in question, and markets driven by hype can cool fast without deep expertise. There are also practical considerations: proper storage, insurance, and climate control add cost, and U.S. regulations impose steep capital gains taxes of up to 28%, with relatively little market oversight.

Key Examples

2016 Nike MAG ‘Back to the Future.' Lot closed, April 6. $90,000 USD.

Phillips | F.P Journe 1993 F.P. Journe Tourbillon Souverain à Remontoire d'Egalité. $8,357,441 USD.

| Category | Example Collectible | Notable Recent Sale | Why it Matters |

| Sneakers | Nike Air Mag (Back to the Future Edition) | A Single Nike Sneaker Sold For Over $90,000 | Pop-culture nostalgia + scarcity |

| Watches | 1993 F.P. Journe Tourbillon Souverain à Remontoire d'Egalité | Second F.P. Journe Wristwatch Ever Made Sells For Over $8.3 Million | Celebrity provenance, brand prestige |

| Cars | 1967 Ferrari 275 GTB/4 | One example sold for $3,595,363 at Bonhams, June 2025. (Sports Car Market) | Heritage + performance + rarity |

| Video Games | Sealed NES Zelda (1987) | CGC-certified Video Games Dominate Heritage Sale; Record-breaking Zelda Realizes $300,000 | Nostalgia + perfect condition |

| Toys | Star Wars Luke Skywalker (1978) | Ultra-rare 'Star Wars' Luke Skywalker toy sells for $84k | Cultural icon + vintage appeal |

| Pop Art | KAWS “Companion” figure | A Rare KAWS "Seated Companion" Gets Auctioned off for $411,000 USD | Crossover of art, design, and commerce |

Where the Next Trend May Emerge

- Limited-edition drops: Monitor sneaker, toy, and watch releases. Today’s hype can become tomorrow’s heritage.

- Secondary-market liquidity: Watch pricing on StockX and eBay. Even traditional auction houses like Sotheby’s, Phillips, and Christie’s are getting in on the action.

- Generational trends: Gen Z’s rising income will shape which pop-culture assets lead the next wave.

- Technology: Blockchain provenance and “digital twins” could transform authenticity tracking.

- Macro backdrop: Inflation and wealth transfer pace will influence tangible-asset demand.

- Bubble watch: Rapid price surges and mass speculative entry can precede pullbacks. Caution required.

Collectibles have officially graduated from hobby to asset class. The combination of demographic change, digital culture, and emotional value has redefined what it means to invest.

As younger generations reshape wealth and taste, the markets of the future may look less like Wall Street and more like Comic-Con. From sneakers and vintage games to exotic cars and pop art, the next great portfolio might just include a little piece of nostalgia...if you know what to look for, and if you’re patient enough to hold it.

Principle Wealth