Prediction Markets: The New Casino

Source: "A timeline of the evolution of gambling from the 1930s to today" prompt. ChatGPT, GPT-4o, OpenAI, January 2026

Prediction markets are a simple idea dressed up in modern finance. At their core, they allow people to buy and sell contracts based on whether a specific real-world event will occur: an election outcome, an interest-rate decision, a court ruling, a sporting event, or even a major geopolitical shift. Each contract typically settles at $1 if the event occurs and $0 if it doesn’t, and the trading price in-between reflects the market’s collective estimate of the odds. If a contract is trading at $0.60, the market is effectively saying there’s a 60% chance the event happens.

For the average investor, prediction markets sit somewhere between investing and gambling: they look and feel like financial markets, but instead of owning a business or a bond, you’re trading on “what happens next.” That simplicity of "win-it-all" or "lose-it-all," combined with real money, real-time prices, and fast resolution, is exactly what has made them so compelling and so controversial.

They are part financial tool, part betting platform, part social network, and part game. They take messy real-world events and boil them down into a single number that updates constantly. And over the past few years, they’ve grown from internet curiosities into something much bigger: a new way to speculate on the future, with real volume, real influence, and real regulatory consequences.

The Main Players

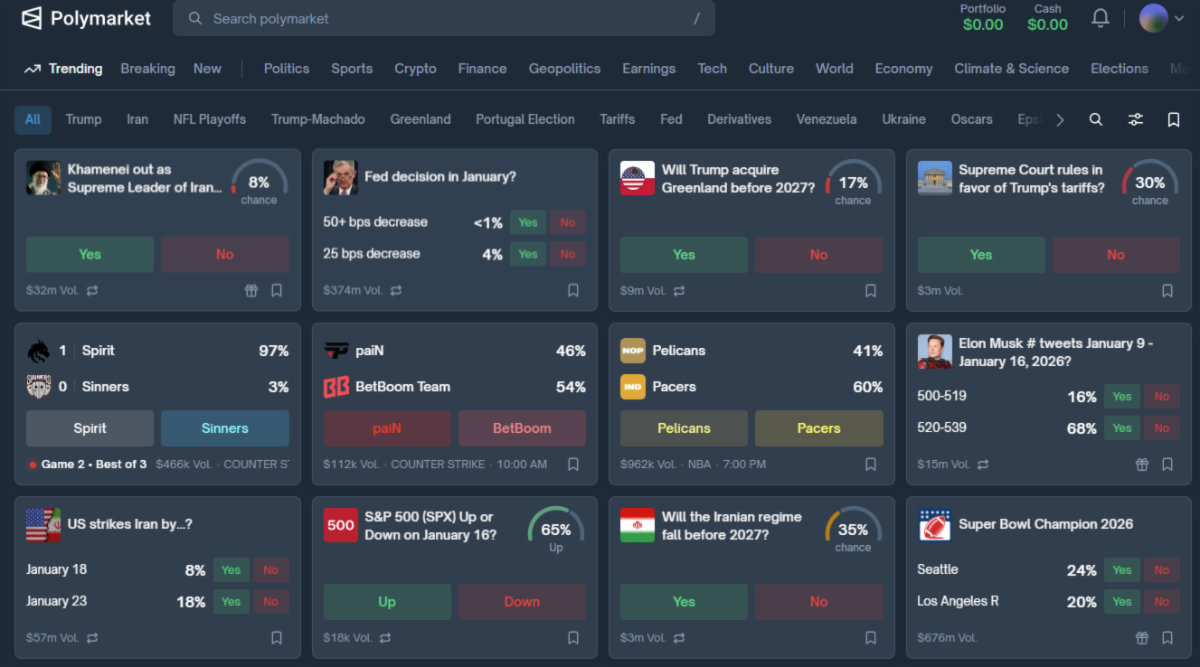

Source: Polymarket

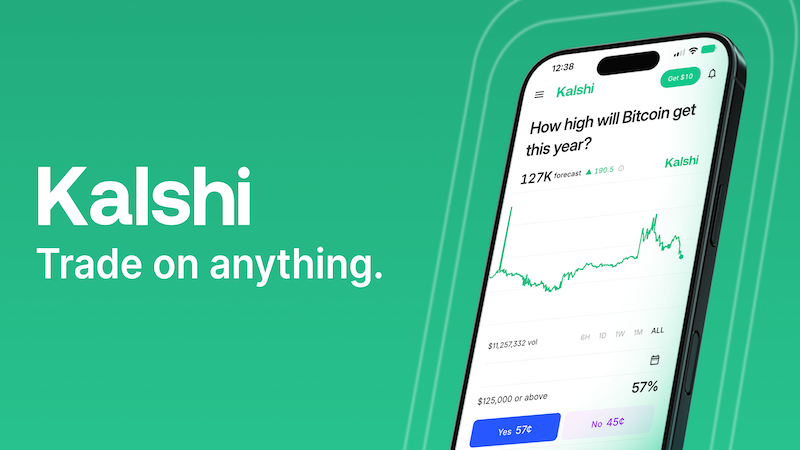

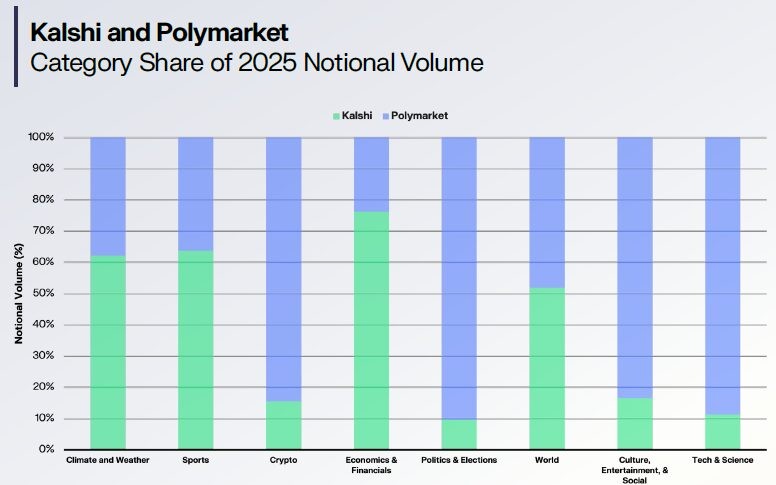

Kalshi, a federally regulated exchange, is pushing these “event contracts” into the financial mainstream. Polymarket, built on the blockchain and often operating offshore, has turned the same idea into a global spectator sport. Together, they’re helping normalize a powerful idea: you should be able to trade your beliefs about the future as easily as you trade a stock.

Although they look similar to users, Kalshi and Polymarket make money in slightly different ways, shaped largely by regulation. Kalshi, which operates as a federally regulated exchange in the U.S., primarily earns revenue by charging transaction fees on trades and settlements, much like a traditional futures or options exchange. Its business model depends on volume, not on predicting outcomes or taking positions against users.

By contrast, Polymarket, which only accepts cryptocurrency as a form of payment, aka crypto-native, typically generates revenue through a combination of trading fees, liquidity spreads, and protocol-level charges embedded within its smart contracts. Because it operates outside the U.S. regulatory framework, Polymarket has more flexibility in market design and pricing, but that flexibility comes with greater regulatory and operational risk.

In both cases, the incentive structure is the same: the platforms profit when people trade, not when they win or lose, reinforcing the idea that prediction markets are designed to monetize participation in uncertainty rather than the outcomes themselves.

A Market for "What Happens Next"

If you think the outcome is more likely than the odds, you buy. If you think they’re lower, you sell. In theory, the price reflects the collective judgment of everyone trading, an ongoing poll backed by money instead of opinions.

In reality, modern prediction markets go far beyond elections or economic data. They cover court rulings, sports outcomes, geopolitical flashpoints, entertainment awards, housing prices, and niche micro-events that feel closer to news-cycle prop bets than traditional forecasting.

As these markets expand, they stop feeling like specialized tools and become a parallel internet, where belief isn’t expressed through posts or arguments but through prices.

Why Prediction Markets Are Taking Off Now

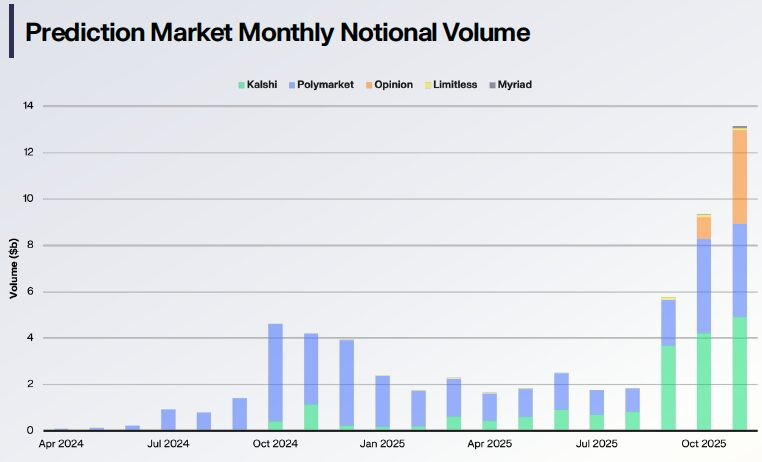

Source: Keyrock, Dune, @datadashboards

This boom didn’t come from one place. It’s the result of several trends converging at once.

1. The apps are user friendly

Trading used to be clunky and intimidating. Today’s prediction platforms feel more like consumer apps: simple interfaces, instant feedback, notifications, and markets you can understand in seconds. That’s not accidental, it’s intentional design.

2. More of the world feels “tradable”

Politics, markets, culture, and media now bleed into one another. In a noisy environment, people want a number that cuts through the chaos. Prediction markets don’t tell you what should happen. They tell you if real dollars are being put behind it. That distinction matters, and it’s compelling.

3. Crypto made it easier

Polymarket’s rise mirrors crypto itself: global access, fast settlement, speculative users, and comfort with financializing just about anything.

4. Regulation split the ecosystem

Kalshi operates under U.S. regulatory oversight and has fought hard over what kinds of contracts it’s allowed to list, especially political ones. Polymarket, by contrast, generally operates outside U.S. jurisdiction. That allows speed and flexibility, but raises obvious questions about oversight, enforcement, and fairness.

5. Volume proved the idea

When you gather enough users, and those users create transactions, it creates volume. When you have volume on both sides, it creates a useful market. By late 2025, annual prediction-market trading volume was being measured in the tens of billions of dollars, no longer novelty money.

A Generational Shift in Speculation

Source: Linas Beliūnas, Fintech Pulse 10/16 (Substack)

There’s a generational story embedded in this growth. What older generations experienced through traditional gambling: casino trips, office pools, or the occasional Powerball ticket, prediction markets have effectively been reimagined for a younger, digital-first audience. The impulse is the same: risk a small amount of money on uncertainty, enjoy the thrill of possibility, and check back to see how it resolves. The format, however, is radically different.

Instead of lottery numbers or slot machines, today’s version comes wrapped in charts, probabilities, and the language of markets. It feels smarter, more analytical, less like gambling and more like having a view. That distinction matters to younger users who grew up trading stocks on apps, following markets on social media, and learning financial vocabulary early.

The demographics reflect this shift clearly. Data released by Kalshi shows that roughly 85% of its users are male, and nearly half of that group is under the age of 30. In other words, prediction markets aren’t just attracting traders, they’re becoming a default outlet for risk-taking and speculation among younger consumers who may never buy a lottery ticket or step into a casino.

For this cohort, betting on the future doesn’t feel fringe, it feels native.

Source: Keyrock, Dune, @datadashboards

What This Means for Traditional Investing

Prediction markets might look like a sideshow, but they’re increasingly influencing how investors think.

1. A new kind of macro

Traditional macro investing trades around effects, interest rates, currencies, and stocks. Prediction markets trade the cause directly. Instead of asking how markets react if something happens, investors can bet on whether it happens at all. That shifts attention away from fundamentals and toward short-term outcomes.

2. Simpler than derivatives...Sometimes too simple

Event contracts feel intuitive. You know the maximum gain and loss. You know when it settles. For experienced investors, that clarity can be useful. For inexperienced ones, it can blur the line between investing and gambling.

3. A rival to polls and consensus

Prediction markets increasingly compete with surveys, analyst forecasts, and expert opinion. Sometimes they’re insightful. Sometimes they’re wrong. Like any signal, they’re useful, but only if you understand who’s trading, why they’re trading, and how much liquidity the market has.

4. New information risks

Markets tied to real-world events invite questions about insider knowledge. Traditional markets have surveillance and enforcement structures to manage that risk. Some prediction markets don’t, at least not to the same degree.

5. Investing becomes an attention game

When the tradable asset is a headline, investors are incentivized to live in headlines. Your portfolio starts to resemble your news feed, and vice versa.

The Gamification Problem

Gamification isn’t just confetti animations anymore. It’s deeper than that. Prediction markets turn belief into a position and attention into liquidity. Three things follow.

First, event contracts resolve quickly. You win or lose, cleanly. That emotional closure is powerful and addictive.

Second, civic life becomes entertainment. Elections, court cases, wars. Serious events become tradable markets. That may aggregate information, but it also risks trivializing outcomes that matter deeply.

Third, platforms control the rules. How an event is defined, who decides settlement, and what happens in edge cases, all of that is power. As these platforms scale, those decisions matter more.

Can Prediction Markets Be Manipulated?

Yes, because they are markets. Thin liquidity, motivated traders, and highly visible outcomes create opportunities to push prices in ways that influence perception, not just profit. That doesn’t make prediction markets useless. It just means they should be treated with the same skepticism investors apply to any price signal.The Regulatory Question No One Has Fully Answered

Prediction markets sit in an awkward place. They feel like gambling, look like derivatives, and increasingly function like media. U.S. regulators haven’t fully decided which framework applies, and different platforms operate under very different rules.So, Where Does This All Go?

At some level, prediction markets aren’t new at all. They’re simply the latest expression of a behavior that has always existed. What prior generations experienced through lottery tickets, casino games, or sports betting has now been repackaged for a digital, financially literate audience. The impulse hasn’t changed…people have always wanted to wager on uncertainty. What has changed is how easy, fast, and intellectually framed that wagering has become. Technology didn’t invent speculation; it friction-reduced it. Seen through that lens, prediction markets are likely to evolve in familiar ways. They’ll function simultaneously as a niche tool for hedging and forecasting, a mainstream retail product competing with sports betting and options trading, and a new information layer that quietly shapes how media, politics, and markets interpret reality. Not one path, but all three at once.

Traditional investing will adjust accordingly. Some investors will use these markets as signals, another data point alongside polls, analyst notes, and macro indicators. Others will treat event contracts like simplified options, drawn to their clarity and fast resolution. Institutions will experiment carefully. Regulators will continue to redraw the line between investing and gambling, just as they always have.

Ultimately, this isn’t just a financial story, it’s an informational one. Prediction markets rest on the idea that the future can be priced and that the price is worth trusting. That promise is appealing in an uncertain world. It’s also dangerous if misunderstood. Markets won’t eliminate uncertainty. They’ll simply make it easier to trade. And once uncertainty becomes liquid, it tends to spread far beyond the platforms that first made it accessible.

Principle Wealth