If This Is a Bubble, It’s the Most Profitable Bubble Ever

Understanding what actually defines a financial bubble and how today differs from previous episodes helps investors stay grounded in reality rather than succumb to fear-driven narratives.

Source: Getty Images, Brooklyn Daily Eagle, October 24, 1929.

What Exactly Is a Financial Bubble?

A financial bubble occurs when asset prices rise far above the underlying fundamentals, often fueled by speculation, credit expansion, and a self-reinforcing belief that prices will keep climbing simply because they already have.

The cycle usually follows the same pattern:

1. A compelling new story that captures public imagination

2. Prices begin rising

3. New investors rush in

4. Credit expands, leverage increases

5. Prices detach from economic reality

6. A trigger causes confidence to break

7. Prices fall sharply as buyers turn into sellers

In the simplest terms, a bubble is excess enthusiasm built on weak foundations.

A History of Bubbles

Source: SFGate.com. Pets.com rose to fame during the late 1990s dot-com bubble, when it launched its initial public offering (IPO). Despite backing from investors like Amazon and support from major underwriters, the company collapsed within a year.

Tulip Mania (1630s)

Often cited as the first recorded speculative mania, rare tulip bulbs traded for the price of a home. Prices collapsed as buyers vanished.

South Sea Bubble (1720)

Fueled by exaggerated profit expectations and political corruption, the South Sea Company’s stock became wildly overvalued before crashing.

The Roaring ’20s Stock Bubble

Fueled by easy credit and widespread margin buying, the 1920s boom ended with the 1929 crash.

Japan’s Asset Bubble (1980s)

Real estate and equities soared to extremes, supported by loose monetary policy and a belief that land values would rise forever.

Dot-Com Bubble (1999–2000)

The internet revolution sparked enormous excitement, but many companies had no profits, no business model, and no path to sustainability.

The U.S. Housing Bubble (2003–2007)

Leverage was embedded throughout the financial system, including subprime loans, adjustable-rate mortgages, and complex derivatives. When confidence cracked, the system unraveled.

What All Bubbles Have in Common

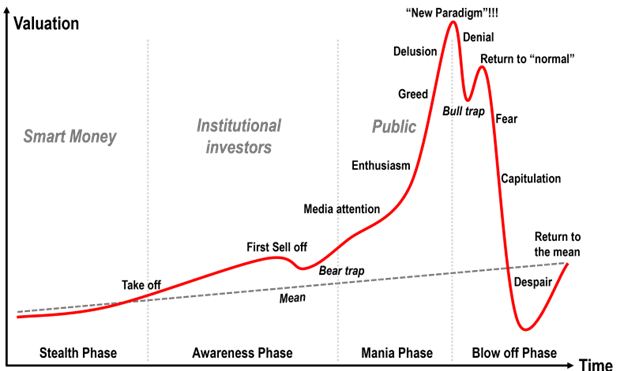

Source: Dr. Jean-Paul Rodrigue, Dept. of Global Studies & Geography, Hofstra University

Despite occurring centuries apart, most bubbles share several characteristics:

1. A powerful, irresistible narrative

From tulips to railroads to the internet to housing, bubbles are built on stories investors want to believe.

2. Easy credit

Excessive leverage accelerates gains on the way up and magnifies losses on the way down.

3. Rapid price acceleration

Prices rise much faster than fundamentals, including earnings or rents.

4. New investor participation

A wave of newcomers, often retail investors, enters the market hoping to “get in while they still can.”

5. Detachment from fundamentals

Valuations eventually lose any anchor to intrinsic value.

6. A trigger that breaks the narrative

Rate hikes, a failed company, policy changes, something sparks a loss of confidence, and momentum reverses.

Does Today’s Market Look Like a Bubble?

Source: Google Trends. As of November 12, 2025. The chart is based on Google Trends search data, which reflect the relative popularity of search terms over time on a scale of 0-100, with 100 representing the peak popularity of the search term during the period. Google Trends data do not measure actual financial market conditions, investor behavior, or sentiment directly. The results are influenced by search volume, geographic location, and Google's proprietary algorithms.

The narrative surrounding artificial intelligence has undeniable momentum. Market concentration in mega-cap technology companies is high. Valuations in certain pockets are elevated. According to recent data from the Bureau of Economic Analysis, AI spending just hit 1% of US GDP in a 1.8% growth economy. So is this AI spending boom a bubble in the making?

We think not. Some key differences, often overlooked in the media, are that today’s market leadership is anchored in real earnings, strong cash flows, and durable business models.

Here’s how today differs from past bubbles:

Today’s leaders are profitable.

The companies contributing the most to index returns, NVIDIA, Microsoft, Apple, Amazon, Google, and Meta, generate enormous, consistent earnings. Dot-com leaders did not.

Leverage is far lower.

Household leverage is down materially from its 2007 level. Margin debt relative to market cap is modest compared to historical manias. Corporate balance sheets are as strong as they have ever been.

Liquidity is high.

We are currently near record highs, with consumers and businesses holding historically high levels of cash.

Monetary policy is restrictive.

Most bubbles form under extremely easy credit conditions. Today, the Fed is tight, not loose.

Systemic financial risk is lower.

Banks are better capitalized, and derivatives are more transparent post-2008.

Retail frenzy has cooled.

The “meme stock” moment of 2020–2021 was a speculative episode, but today’s flows are more normalized.

Innovation is economically meaningful.

AI, cloud computing, biotech, and semiconductors are shaping business models across industries. This is not speculative vaporware. It’s a tangible productivity improvement.

Certain stocks can be expensive, and corrections are normal. But structurally, the market today does not resemble the classic conditions seen in prior bubbles.

Why Investors Should Approach Bubble Talk With Caution

The greatest risk with bubble headlines is overreacting. Selling a long-term portfolio out of fear often proves far more damaging than riding through volatility.

A more useful approach is:

· Stay valuation-aware but not valuation-paralyzed

· Focus on fundamentals, especially earnings quality

· Use diversification to avoid concentration risk

· Distinguish between strong businesses and speculative ones

· Keep decisions anchored to long-term financial goals

Markets and media will always generate noise, and bubbles will always be part of financial history. But not every strong market is a bubble, and not every bubble poses a systemic risk. While periods of overvaluation in individual companies are inevitable, today’s market strength is driven by fundamentals. We are seeing durable earnings growth, strong balance sheets, ample liquidity, and businesses generating real cash flow. Innovation is delivering measurable productivity gains, not just compelling narratives. This growth is being funded by profits rather than easy credit. As a result, while corrections are inevitable, markets grounded in profitability and financial discipline tend to be far more resilient than those built on hype.

Principle Wealth