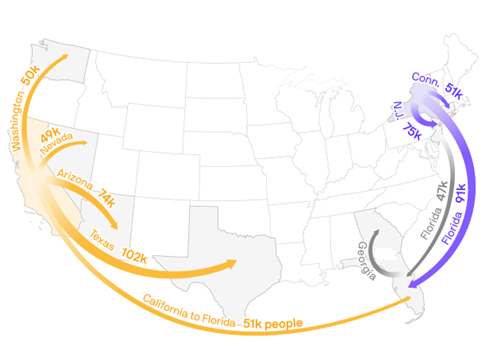

The Great Migration

Top Ten Moves Between States, 2022

Source: Data: U.S. Census American Community Survey; Chart: Erin Davis/Axios Visuals

A substantial shift is underway in the U.S., with residents fleeing high-tax states like California, New Jersey, and New York for more tax-friendly regions. This movement, driven by a cocktail of high taxes, increased crime, and cost of living pressures, is set to reshape the nation's economic profile.

The Catalyst

High taxes lead the charge in reasons for migration. In California, the top state income tax rate is a hefty 13.3%, the highest nationwide. New Jersey and New York follow closely with top rates of 10.75% and 8.82% respectively. Add city taxes, and New Yorkers could be paying up to 52% in taxes. The COVID-19 pandemic has further fueled this migration, as remote work opportunities allow for location flexibility.

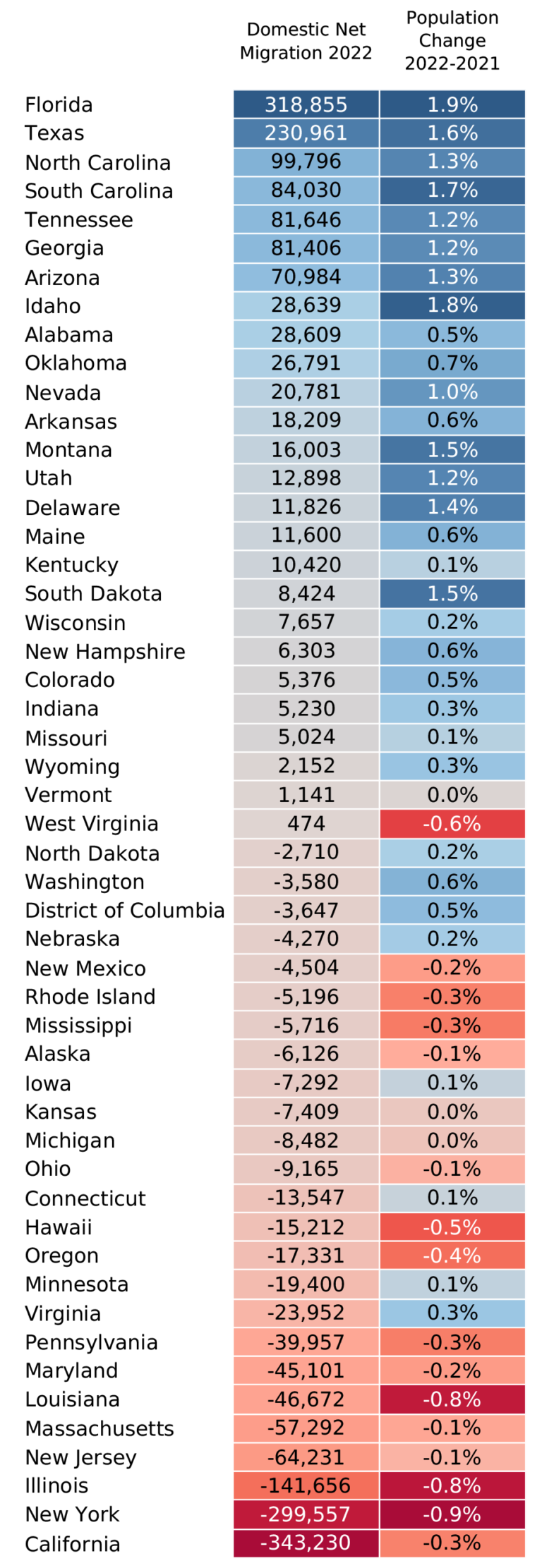

Source: U.S. Census Bureau, Vintage 2022 estimates | National Association of Realtors

The New Horizons

Tax-friendly states with lower living costs, like Florida, Texas, and Nevada, are reaping the benefits of this demographic shift. Tennessee and North Carolina also join the list with competitive tax structures. However, the shift isn't solely tax-motivated. Factors like Florida's appealing climate for retirees and Texas's vibrant job market and affordability make them attractive destinations.

The Impact

The ramifications of this shift are significant. High-tax states risk dwindling tax revenue and resulting budget shortfalls, forcing a rethink of tax policies or potential cuts in public services. Conversely, the states welcoming newcomers could see economic growth and increased tax revenues, albeit at lower rates.

However, the influx brings its challenges. Increased demand for housing could drive up real estate prices, and strain on infrastructure, such as power grids, schools, and public transportation, could increase. A case in point is Nevada, already grappling with public water supply issues.

Political landscapes could also shift as migrants bring their ideologies to their new homes. The question arises: will migrants integrate into the local culture or import the ideologies that prompted their original departure?

In conclusion, this migration from high-tax states is a complex issue driven by multiple factors. Policymakers will need to balance economic growth, fiscal responsibility, and quality of life as they navigate this changing landscape.

Andrew Cialek, CFP®