Jackson Hole

Every year the Kansas City Fed holds a symposium regarding relevant economic conditions and topics. Since 1982, the conference has been held in Jackson Hole, WY, but as COVID-19 continues to persist, this year’s conference was held virtually. Fed Chairman, Jerome Powell gave opening remarks regarding the current state of the economy and where the Fed thinks it will continue to go. To no one’s surprise, inflationary concerns were mentioned, and Powell made it clear that while prices have risen broadly, many of these increases can be easily explained.

Due to the sudden drop-in economic activity at the onset of the pandemic, these inflation numbers became distorted. Consumers transitioned from service-based goods to more durable goods, causing an increase in the inflationary reading of 1% alone just from durable goods. That pressure has since started to fade and for example, service-based goods like airlines and hotels are starting to raise prices.

Powell’s remarks were positive overall, mentioning how the pace of hiring workers is the fastest ever recorded and that “employers can’t fill jobs fast enough”. As government COVID-19-related benefits start to phase out we should see more job seekers looking to take work. Finally, Powell concluded the Fed could start to taper bond purchases later this year as the economy has made “substantial further progress” in their tests. Powell reiterated that this tapering should not be indicative of a rise in interest rates, and that they will continue to monitor the situation over time.

Tesla – more than a car company?

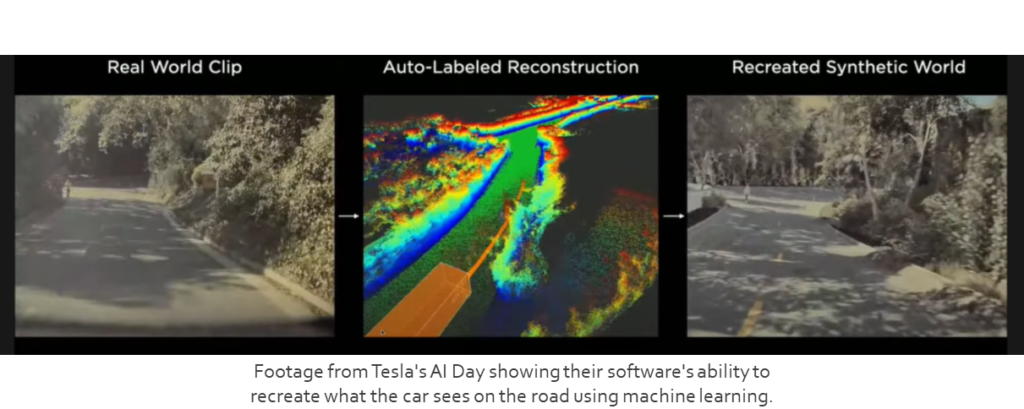

The headline you probably saw involved Tesla’s new robot. During Tesla’s recent AI Day, plans were revealed to create a 5’8”, 125 lb. robot that will be used to do “work that people least like to do”. The bot should be able to deadlift up to 150 pounds and move as fast as 5 miles/hour. The company hopes to create a working prototype by next year, but given Tesla’s previous project timelines, that could vary quite a bit from reality.In addition to the robot, Tesla also revealed several other notable items including manufacturing their own computer chip. It’s not news that auto manufacturers and other technology companies alike have been suffering from a chip shortage, and demand should only increase as companies pivot to newer technology. By bringing production in house on some of the most important components, Tesla strengthens their supply chain and should become more resilient over time. This in-house technology will also aid in the development of their supercomputer, Dojo, the neural network training computer to be used for processing vast amounts of data to help create a stronger AI and Full Self-Driving pipeline.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com