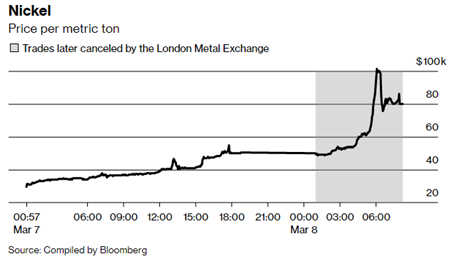

High energy prices might be top of mind for consumers; however, Mid-March brought one of the wildest price increases seen in the commodity market in quite some time for nickel. In the past decade, the nickel market tended to trade between $10,000 and $20,000 per metric ton, but a few speculative bets caused the nickel market at the London Metal Exchange (LME) to explode upwards of $100,000 on March 8th.1 It is important to note that commodities markets don’t operate like your typical stock market. Mining companies, traders, and manufacturers use commodities markets to hedge their pricing and make short bets to take advantage of mispricing in the market. The 250%+ increase in the nickel market within a couple of days caused massive financial damage for those speculating against the price of nickel, wanting it to fall.

This price spike was mainly due to a short squeeze by a Chinese company, Tsingshan Holding Group. Over the past several months, the industrial metals company (and the world’s biggest producer of nickel and steel) had been making bets that the price of nickel would fall, but the Russian invasion of Ukraine caused the market to move against them, forcing them to cover their bets.2 To close out the bets, the company was forced to buy at higher prices, which put further upward pressure on the price, causing it to spiral out of control. As the month ends, the nickel market is still out of sorts, as traders and companies are trying to figure out how best to manage this commodity. The price of nickel has since fallen back down, but the volume of contracts has dropped significantly, bringing into question whether the LME is the best way to manage these prices going forward.3

Rising Food Prices Hit Consumers Everywhere

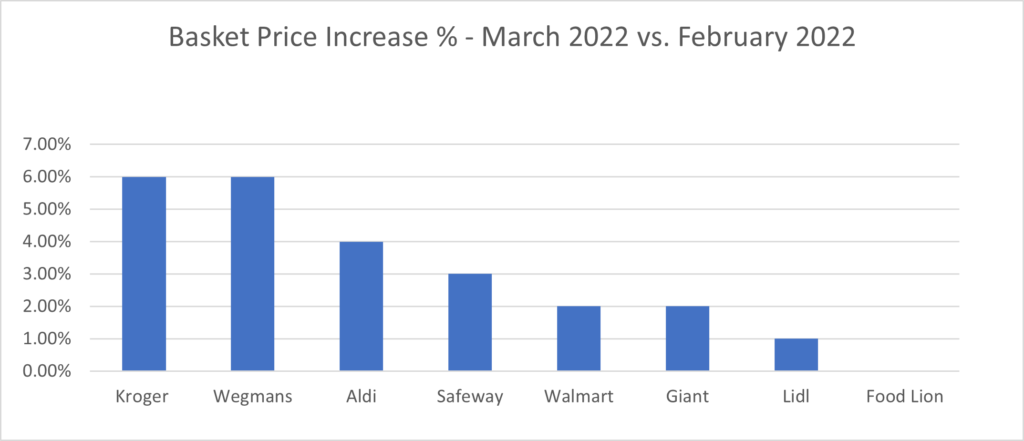

Another persistent headline this year has been increasing food prices. As evidenced by the chart above, most major chains have seen increases month over month. Prices vary from retailer to retailer. Some have passed on the increases, while others have waited, looking to keep prices stable for as long as possible to prevent losing market share. As prices increase, some consumers may look to shift their preferences from brand names to private labels, which adds more complexity to the situation.4

While wheat exports have monopolized news headlines recently, other household staples have also been impacted. Fertilizer costs have increased due to the Russia/Ukraine conflict, and cooking oil prices rose because of labor shortages in Asia along with drought-damaged crops in Canada and South America.5 While the United States is fairly insulated in agriculture, less supply of a good globally drives demand in the remaining areas. The most significant impact will most likely be seen in emerging nations that spend a higher % of income on food compared to developed nations.

1https://www.bloomberg.com/news/articles/2022-03-14/inside-nickel-s-short-squeeze-how-price-surges-halted-lme-trading

2https://www.ft.com/content/2cb73138-24ae-4e10-a8fd-5558c7155461

3https://www.bloomberg.com/news/articles/2022-03-29/nickel-paralysis-deepens-as-battered-market-barely-trades

4Barclays Food Price Update Call with Roger Davidson, March 25

5https://www.bloomberg.com/news/articles/2022-03-28/rising-food-prices-could-spell-social-unrest-demand-destruction-and-less-bacon

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. The information provided does not constitute investment advice and should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. You should consult your attorney or tax advisor. Principle Wealth Partners LLC is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Principle Wealth Partners and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at https://principlewealthpartners.com